Higher refining margins helped Reliance Industries Ltd. (RIL) to maintain its profitability in the fourth quarter ended March 31, 2014, when its domestic exploration business received a setback due to drop in production.

RIL reported a net profit of Rs.5,631 crore during the quarter under review as compared to Rs.5,589 crore in the year ago period, up 0.8 per cent Sales turnover was higher by 12.9 per cent at Rs.97,807 crore against Rs.86,618 crore.

For the whole of 2013-14, RIL reported a 4.7 per cent growth in net profit at Rs.21,984 crore against Rs.21,003 crore in the previous year. Sales turnover increased by 8.1 per cent to Rs.4.01 lakh crore from Rs.3.71 lakh crore.

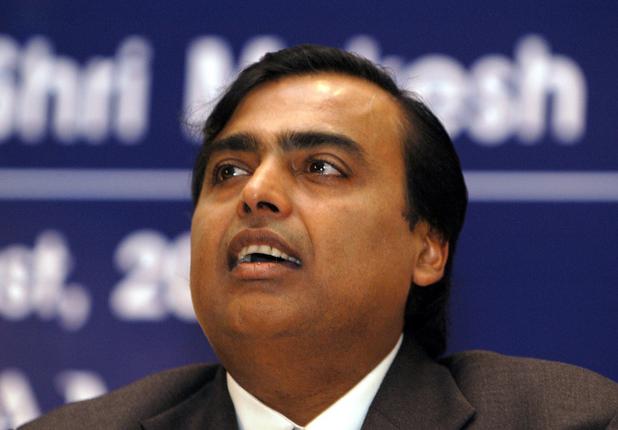

“Financial year 2013-14 was a satisfying year for RIL. Refining business delivered the highest ever profits with a sharp recovery in gross refining margins (GRM) towards the end of the year. Petrochemical earnings grew sharply with margin expansion across polymers and downstream polyester products,” Mukesh D. Ambani, Chairman and Managing Director, RIL, said in a statement.

“While we continue to face technical challenges in growing domestic upstream production, the U.S. shale gas business grew significantly during the year and has become a material contributor to our earnings. Retail business has turned around and is now India’s largest retail chain. We have also accelerated efforts to roll out our state-of-the-art 4G services across the country which will add an exciting new dimension to our consumer facing service offerings,” Mr. Ambani said.

In the domestic exploration and production business, RIL received a setback at the KG-D6 and Panna Mukta fields. The KG-D6 field produced 2.03 million barrels of crude oil, 0.28 million barrels of condensate and 178 BCF of natural gas in FY14, a reduction of 30 per cent, 30 per cent and 47 per cent, respectively on a year-on-year basis. “Fall in production is mainly attributed to the geological complexity and natural decline in the fields and higher than envisaged water ingress,” RIL said. However, RIL’s shale gas business continued on its growth path and has now achieved materiality in many respects. “During 2013-14, revenues were $893.3 million and EBITDA (earnings before interest, tax, depreciation and amortisation) was $659.4 million reflecting year-on-year growth of 45 per cent and 37 per cent, respectively. Going forward, shale gas will continue to be our focus area and this year we will be investing $600-700 million and will open 125 to 175 new wells this year,” RIL Chief Financial Officer Alok Agarwal said at a press briefing.

On the deadlock over the natural gas price issue from KG-D6 fields, Mr. Agarwal declined to give any specific answer. “We are where we were. Let us see what is coming out from the government notification. We have an issue and we need to deal with it,” Mr. Agarwal said. Asked whether the fertilizer companies have responded to RIL’s demand to furnish bank guarantee, he refused to answer.

In the refining and marketing business, RIL witnessed revenue growth of 8.4 per cent. RIL’s GRM for the financial year was $8.1/bbl as against $9.2/bbl in the previous year. “GRM improved sharply in the fourth quarter to $9.3/bbl from $7.6/bbl in the previous quarter,” it said.

RIL’s petrochemical business in 2013-14 witnessed a revenue growth of 9.5 per cent year-on-year to Rs.96,465 crore. Revenue growth was led by 8.6 per cent increase in prices and 0.9 per cent growth in volumes, the company said.

Reliance Retail achieved record performance in sales and profits for the year. Total revenue grew by 34 per cent to Rs.14,496 crore and achieved PBDIT (profit before depreciation, interest and tax) of Rs.363 crore. “This achievement was in spite of the continued challenging macro-economic environment,” the company said.

RIL did not spell out the exact roll-out timing of its telecom service under Reliance Jio Infocomm. The company has so far invested Rs.33000 crore in this business and services are expected to be launched in the near future.

“The results are on expected lines. Net profit could have been better. While depreciation charges dampened profits, refining margins have helped in improving profit. The GRM is much better than the Singapore benchmark,” said Devan Choksey, Managing Director and CEO, KR Choksey Shares & Securities.